Differentiation between VCs

If differentiation is important for startups, it’s equally (if not more) important for VCs.

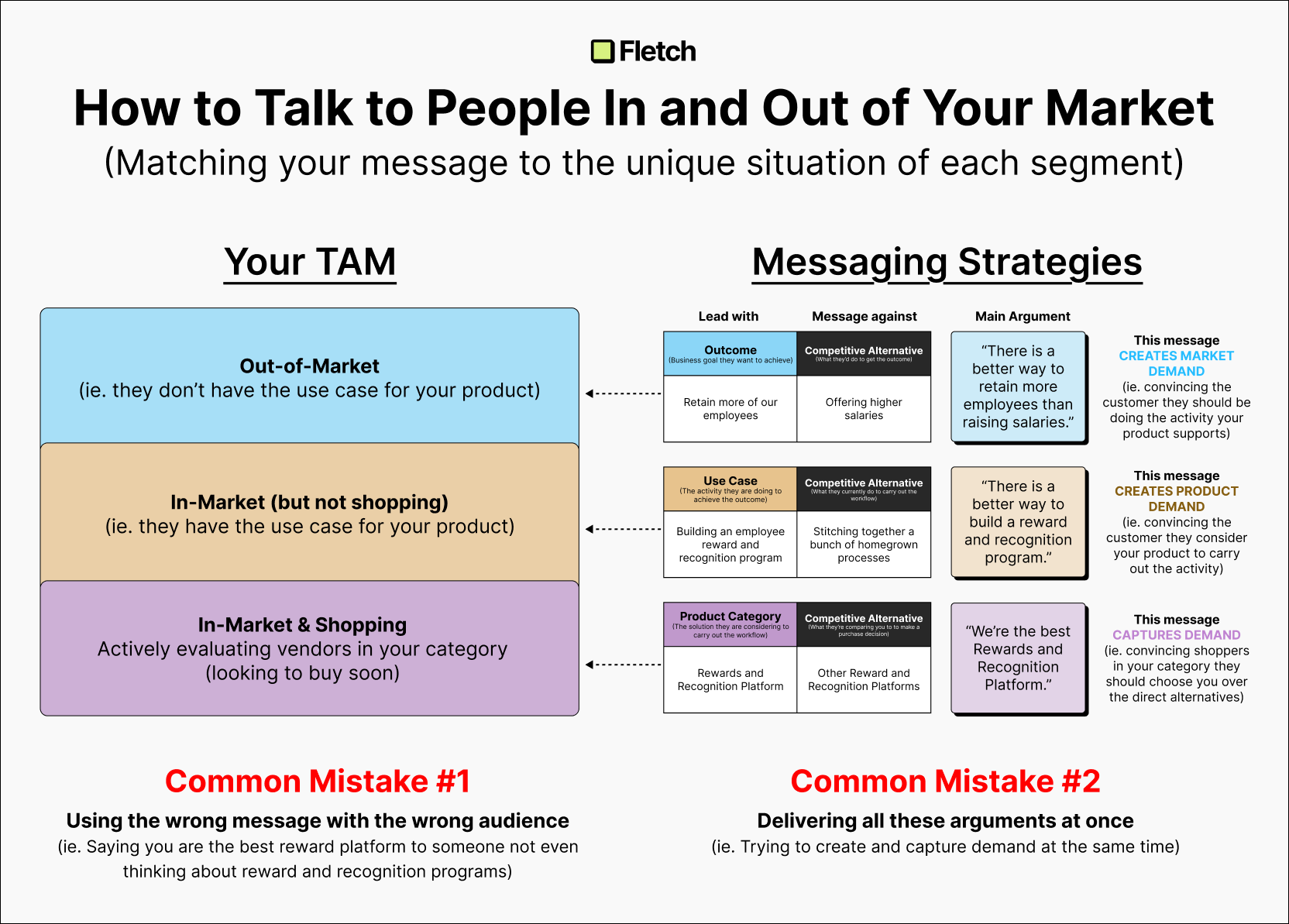

- Founders need to convince customers to buy their products.

- Venture capitalists need to convince founders to take their money… AND limited partners to give them money.

When there’s a potential unicorn, VCs compete against each other—and other forms of capital—for a piece of their future success.

(Think SharkTank but not on TV)

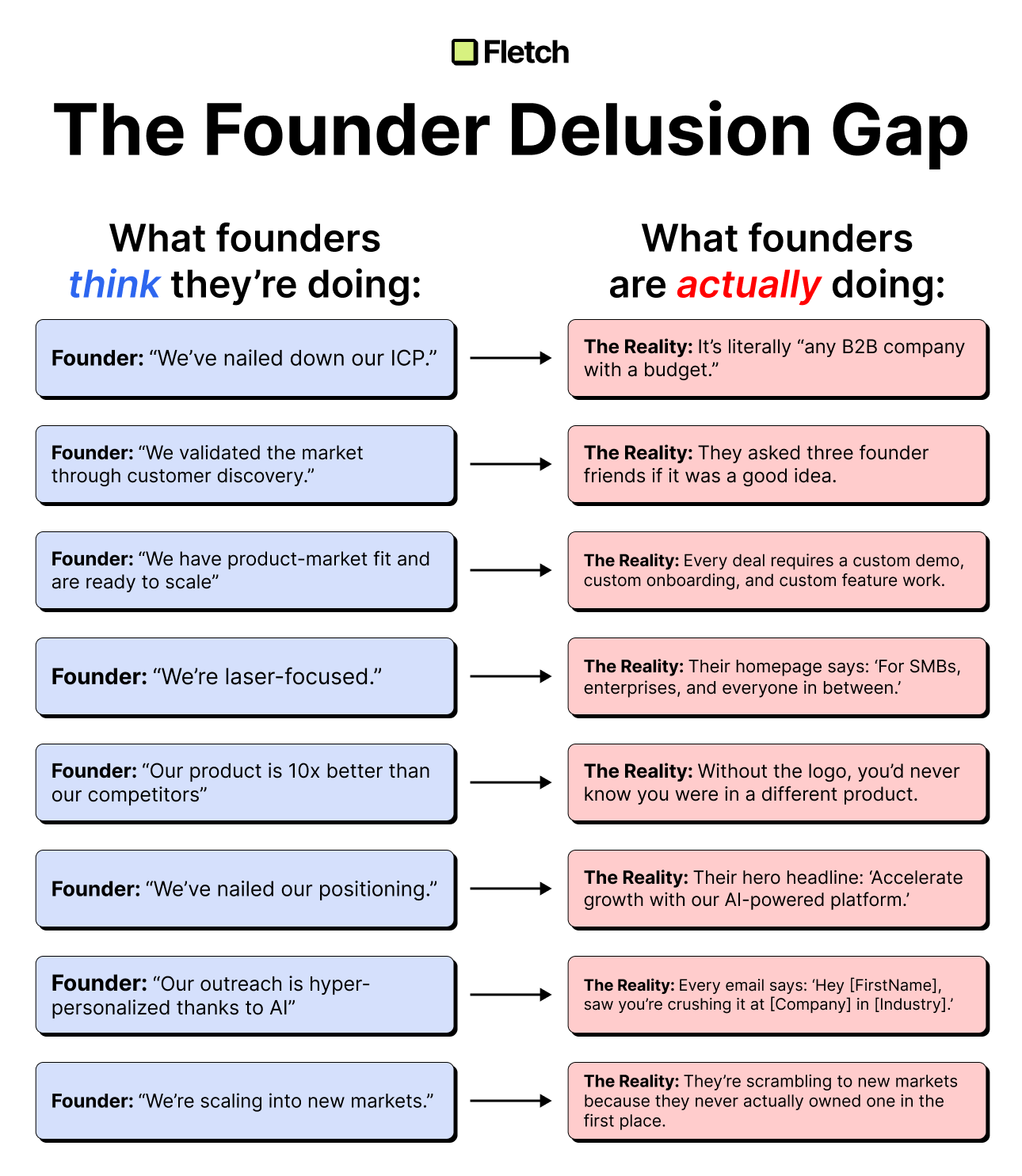

And their current strategy for differentiation?

- “Look at the super successful companies we’ve funded!”

But as you can see, all the big VC firms have funded incredibly successful startups.

So why go with Accel over Sequoia?

VCs shouldn’t make potential portfolio companies figure this out for themselves.

It should be obvious from a quick look at their website.

This table was built to compare the value props of four VC firms—Sequoia, Accel, OpenView, and First Round capital—using JUST information on their homepage.

First Round does the best job (by far) of explaining why you should choose them over the alternatives.

(Which makes sense with their partnership with positioning/product marketing legend Arielle Jackson)

The rest seem to mostly be resting on the power of their brand.

Ben Wilentz

Founder, Stealth Startup